Earlier this week, I showed you how I spotted a massive $3.3 million call buy — the kind of move that tells me smart money is getting into position before the headlines hit.

But here’s the thing…

Just because a big trade hits the tape doesn’t mean it’s a good setup.

You can’t trust volume alone.

Because these days every chat room, AI bot, and news algorithm is tracking options flow. The noise is off the charts.

So how do I cut through the garbage?

Simple: I apply a trend filter.

The Trend Filter I Use Every Day

Before I ever act on unusual volume, I apply a 20-day, 50-day, and 200-day exponential moving average (EMAs) on the chart.

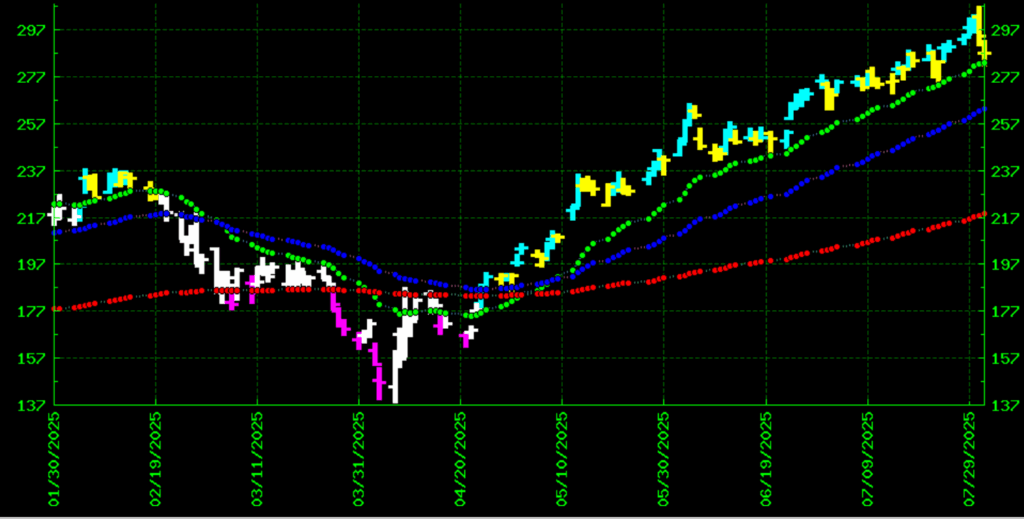

You can do it on just about any trading platform. Here’s what AVGO looks like on my custom-built TrendPoint software right now:

See how the green (20 day), blue (50 day) and red (200 day) trendlines are all sloping gently upward — with the 20 on top, the 50 in the middle, and the 200 on the bottom?

That tells me the stock is actually trending — not just bouncing around or reacting to hype.

If I see strong call volume and a bullish trend setup?

Now I’m interested.

Why Trend Matters

Let’s say I see 50,000 calls bought on a random stock.

Everyone starts buzzing. “Unusual activity! Big breakout coming!”

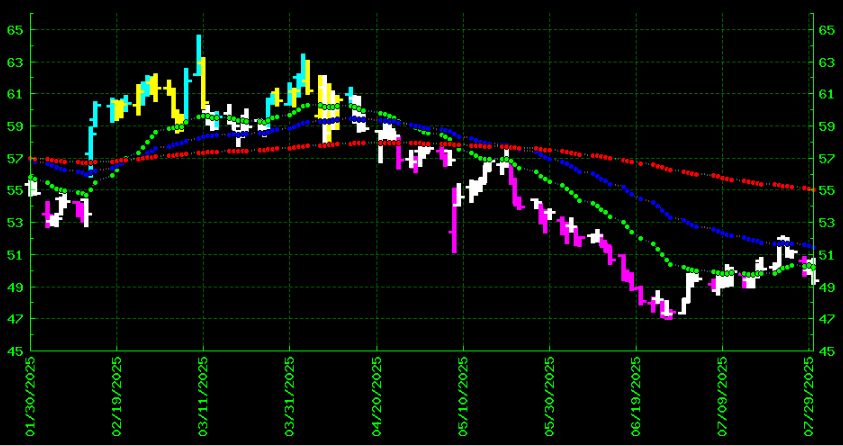

But I pull up the chart… and the stock’s stuck below a declining 50-day average like this?

Pass.

That’s a trap. That’s the kind of thing that gets rookie traders chasing momentum and burning cash.

I only want to trade setups where I’ve got both:

1) Smart money stepping in

2) A bullish trend that’s already in motion

That’s when I know I can stack the odds in my favor.

What I Do With That Info

When those two things line up, I don’t jump in with some Hail Mary call option.

I sell premium.

Maybe I sell a naked put 5–10% below current price.

Maybe I run a bull put spread for quick income. (sell the strike below the current price and buy another strike below that)

Maybe I buy the stock and sell covered calls.

But either way, the key takeaway is that I’m collecting cash up front — and letting the smart money do the heavy lifting.

That’s where the real edge is.

Trade Well,

Jack Carter

Jack Carter Trading

P.S. This brand new tool automates my entire strategy. It might be the biggest thing I’ve done in my 40 years of trading it.