Hey Traders,

Take a look at the market.

No really — look at it.

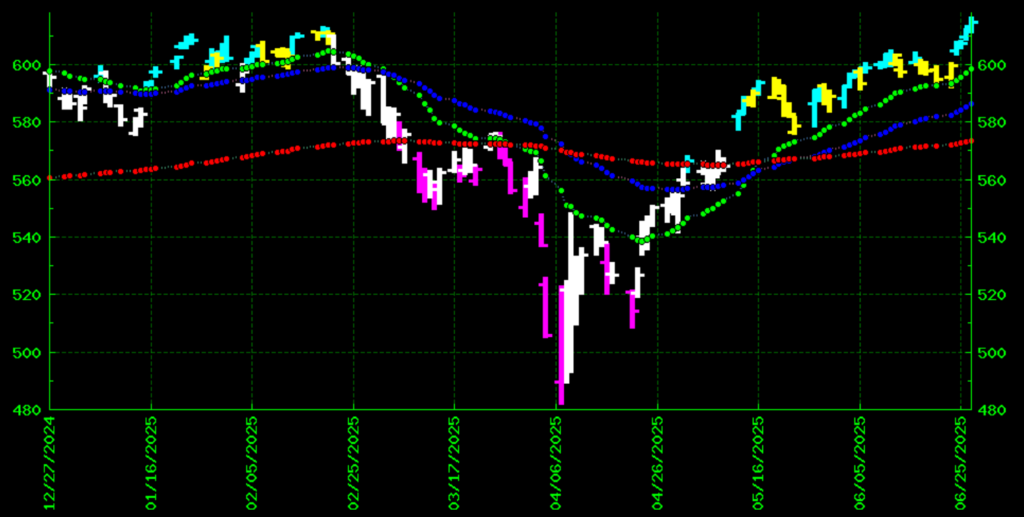

That’s the SPY over the last six months with daily candles. Now think about all the headlines we’ve heard recently:

- Bombings in Iran

- Tariff talks getting paused and restarted (and pause and restarted…)

- The Fed refusing to cut rates

- GDP coming in lower than expected

- Congress going back and forth on that “Big Beautiful Bill”

If you were trading the headlines, you’d probably think the market’s in trouble. But now ask yourself…

What’s really been happening?

The Market’s Been Shrugging It All Off

Despite all that noise, the market’s been marching up.

Relentlessly. Higher highs. Higher lows.

And if you look close — really close — there’s a lesson buried in that chart that’s too important to miss.

What Are Blue Candles?

In my custom-built TrendPoint software, blue candles represent days where the market makes both a higher high and a higher low — a strong signal that the uptrend is strong.

That’s a good thing. Until it’s not.

Because when you get too many of those in a row, price tends to stretch way above the short-term trendline — the green line on the chart — and that’s when we usually see the market pull back.

Strength Needs to Breathe

It’s not catastrophic. It’s not a crash.

It’s just how markets work.

Even the strongest trends need to take a breather.

So when I see 3-5 blue candle days in a row, I start expecting a short-term drop. Nothing major — just a healthy reset down to about the green line.

And that’s exactly where we are right now, waiting for that return to the green line.

What You Should Do

So if you hear some dramatic, doom-and-gloom headline in the next day or two — don’t panic. Don’t go reacting to the news.

Follow the structure.

Because structure tells the truth. Headlines just tell stories.

And right now the charts are telling us that markets are in bullish mode.

Trade well,

Jack Carter

P.S. Have you seen this income strategy that targets weekly payouts whether the stock goes up down or nowhere at all? Check it out here.