>>>I’ll be live with Jeffry Turnmire at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more, Click Here to join<<<

There are a handful of positions in my portfolio that I never trade… I just sit on them.

No covered calls. No cash-secured puts. No weekly wheeling.

Just buy, hold, and collect.

I’m talking about my 3 E’s:

- Energy Transfer (ET)

- Enbridge (ENB)

- Enterprise Products Partners (EPD).

These are midstream energy partnerships — and if you’ve never heard that term before, think of them as toll roads for oil, natural gas, and water.

These companies do not drill. They do not pump. They do not care if oil is at $50 or $150 a barrel.

They just move the stuff through their pipelines. You want to move your oil? It has to go through that pipeline. And they’re going to charge you for it.

That is why these didn’t get hit that hard when oil tanked.

Their business model is not tied to commodity prices. It is tied to volume. Push it through the pipe, it is going to cost you — whether it is oil, water, or natural gas.

Another reason these companies are so solid is that building new pipelines has become almost impossible. Regulations are so tight that it’s usually cheaper for the big players to buy out smaller existing pipelines than to even think about building new ones.

That creates a moat you do not see in most industries. The barriers to entry are not just high — they are basically locked.

Why I’m Not Writing Options on These

I own about 1,000 shares of one of these and I do not write any options against it. I just collect the dividends.

Here‘s why: These do not move enough week to week to make covered calls worth it. You would have to go out months and months to get any decent premium and at that point you are tying up shares for income you could get faster elsewhere.

But the dividend? That is a different story.

My yield on cost on ET is closer to 9% now, even though the stated yield might look lower. That’s what happens when you hold something long enough and the distributions keep climbing.

One thing to understand, though, is these are partnerships, not traditional corporations. Their payouts do not qualify for the lower dividend tax rate.

You are paying a bit more in taxes, but the income stream more than makes up for it. Just know what you are getting into so there are no surprises at tax time.

The Regulatory Moat You Do Not Hear About

The tough regulatory environment does not just slow down expansion — it protects the companies that already have their pipelines in the ground.

When it is cheaper to acquire old infrastructure than to build new routes, the existing players get stronger. That kind of moat does not show up on a balance sheet, but it matters.

Another thing I like about these names is that you can see real confidence from the people running them. One of the insiders at one of these firms buys shares nonstop. When someone that deep in the business keeps putting their own money in, that is a loud vote of confidence.

In terms of solid businesses, this sector is not going anywhere. They can develop all the wind and nuclear they want, but oil and gas infrastructure — especially midstream — is not disappearing.

So if you are looking to park some capital and let it work for you — no drama, no headlines, no panic — these are awesome. They go up a little, down a little, but they pay.

I am not saying dump your whole portfolio into pipelines. But if you want a corner of your account that quietly throws off cash while you trade the rest, the 3 E’s are worth a look.

Trade well,

Jack CarterJack Carter Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram://t.me/jackcartertrading1

- YouTube://www.youtube.com/@FinancialWars

- Social media:

- Social media:

Important Note: No one from the ProsperityPub team or Jack Carter Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. The Urgent Market Setup Supercharging Wall Street’s Most Predictable Stock Move

Can I let you in on a secret that the government shutdown just triggered?

It’s created a rare market setup… one that ties directly to a powerful phenomenon unfolding on one of Wall Street’s biggest stocks.

And you can “hijack” this phenomenon to target payouts of $1,250 on a $2,500 stake… week in and week out.

No matter what’s happening in the market.

I know that sounds hard to believe…

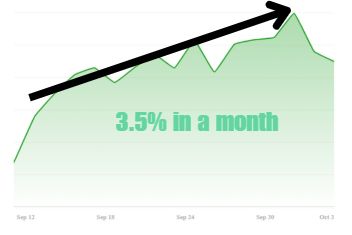

But thanks to this phenomenon, a few traders had the opportunity to quietly book a perfect run through September.

That’s an extra $5,010 without doing too much.

Mind you, the S&P moved 3.5% in the same month, so the same sized stake in the market would have returned only $87.

Now of course there were smaller winners, and those that didn’t work out. There are bound to be winners and losers in trading.

But this market setup is set to supercharge this special phenomenon even more…

And there will be tons of more opportunities to target payouts like $1,250 on a $2,500 stake.

The only question is…

Will you get lost in the noise like everyone else?

Or will you leverage this phenomenon for what I believe is the #1 way to take advantage of this opportunity?

If you’re going with the latter…