Past articles

About

JACK CARTER

I’ve been watching something unfold that a lot of folks didn’t see coming. Bitcoin’s decline is creating a cascading effect across multiple asset classes, and it’s not just about the price.

It’s about the psychological impact on crypto and everything connected to it.

The Ripple Nobody Expected

BlackRock (BLK) has taken a beating as IBIT’s experienced massive outflows. That’s not a small thing when you’re talking about one of the largest asset managers in the world getting hit hard by Bitcoin exposure.

But it doesn’t stop there.

MicroStrategy (MSTR) is facing a serious crisis with the potential MSCI delisting, and there’s a bigger layer to that story. Nasdaq rules for the Nasdaq 100 (QQQ) restrict companies from having more than half their assets concentrated in a single commodity, and MicroStrategy’s heavy Bitcoin positioning is putting it directly in the crosshairs.

That regulatory pressure is becoming just as much of a threat as the price action itself.

Coinbase (COIN) is declining because there’s going to be less trading and lower total asset values in its broker-dealer. When the underlying assets drop, the platforms that facilitate trading those assets take a hit too.

All of this has turned into a ripple effect that caught nearly everyone off guard. One little thing like Bitcoin can hurt so much other stuff, and if MicroStrategy ever has to liquidate, there won’t be enough buyers to absorb it all.

That could be a backbreaker for the stock.

The surprising part is how quickly this all materialized. No one really saw this coming, and the speed of the shift is causing real stress across the market.

The Store of Capital Narrative Is Cracking

Bitcoin is proving more volatile than people thought, and that’s contradicting the entire store of capital story that’s been pushed for years. This drop is hitting confidence in a big way.

And it goes beyond charts. The decline is creating a psychological effect across crypto. Investors who believed Bitcoin was a safe haven or long-term stabilizer are being forced to rethink that narrative.

When people realize something isn’t the secure store of value they thought it was, sentiment shifts fast — and that shift can be more damaging than the price decline itself.

Even Schwab is discussing how Bitcoin is more volatile than people think. When the big retail platforms start warning clients, you know the narrative is shifting.

Everyone who thought Bitcoin would hit $250,000 by year-end is getting a rude awakening. Instead of moonshots, we’re seeing Bitcoin drop another couple percent while the bulls scramble to explain it away.

The damage extends far beyond just the coin itself. Billions have been knocked off valuations across anything Bitcoin or blockchain related — that includes Robinhood (HOOD), Circle (CRCL) and every other company tied to the space. This is the ripple effect I keep telling people about — Bitcoin is a real danger.

Now, I’m not saying Bitcoin is going to zero or that crypto is dead. But I am saying the volatility is real, the risk is real, and the interconnected nature of these assets means one bad move can cascade fast.

For what it’s worth, I’m willing to be assigned IBIT shares if it comes to that. I believe in the long-term potential but I’m also sizing my risk appropriately and not betting the farm on a single narrative.

Stay disciplined out there. The market doesn’t care about your thesis — it only cares about price.

Trade well,

Jack Carter

Jack Carter Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: //t.me/jackcartertrading1

- YouTube: //www.youtube.com/@FinancialWars

- Social media:

- Social media:

Important Note: No one from the ProsperityPub team or Jack Carter Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

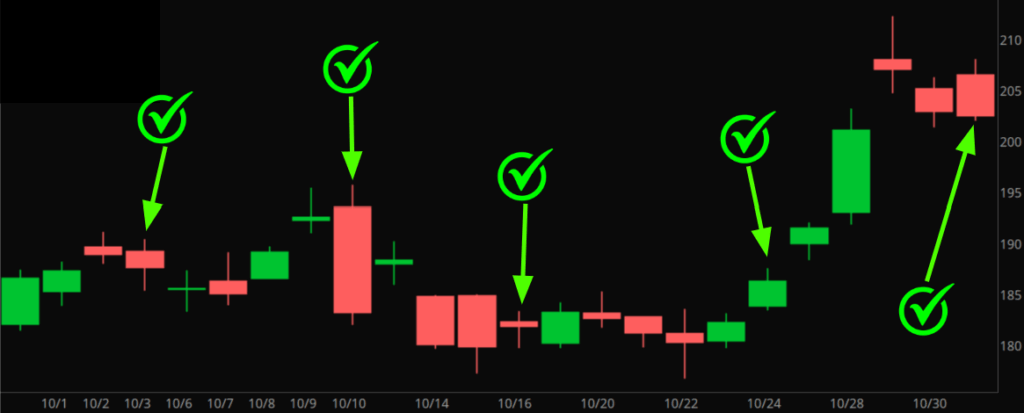

P.S. Discover the New ‘Income Glitch’ Breakthrough

You’ll get a full breakdown on the market anomaly that paid out FIVE times in October.

And Jack will reveal the newest “income glitch” opportunity that just triggered.

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. From 1/1/21 through 11/12/25, the average return per options trade alert published in real time (winners and losers) is 2.81% in 3 days, with a 95.9% win rate.